How Mobile Platforms and AI Will Create a Super Connected Ad Experience

October 28, 2025

US Digital Advertising Market Growth Aims for Stable Growth in 2026

December 9, 2025

That first-party data is advertisers' most valuable asset, but here's what most don't realize: they're only the tip of the iceberg.

While brands obsess over maximizing customer transaction data and perfecting CRM strategies, they systematically ignore the largest pool of proprietary intelligence they possess—their campaign impression logs. The result? Billions of behavioral signals that could unlock competitive advantages remain trapped in data warehouses, analyzed only after campaigns end, if at all.

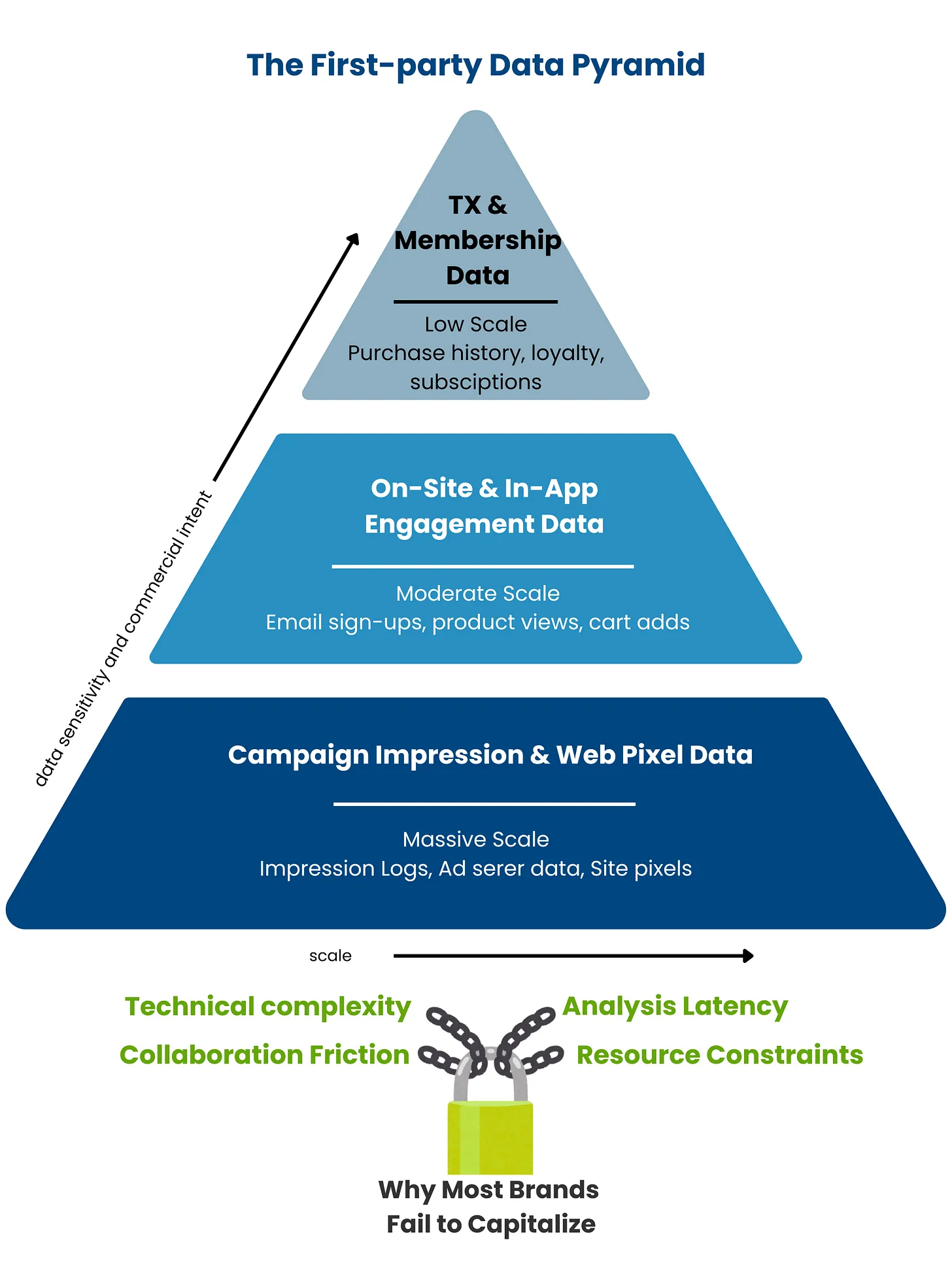

The strategic value of first-party data is best understood as a pyramid, where the vertical axis represents data sensitivity and commercial intent, while the horizontal axis represents scale. The most sophisticated advertising strategies aren't built on a single tier, but by strategically orchestrating the interplay between all layers of this largely unmined goldmine.

The Apex: Transactional & Membership Data (The High-Value Seed)

At the narrow peak sits the most commercially potent data any advertiser possesses—but paradoxically, the least scalable for growth.

Data Types: Purchase history, transaction values, loyalty program status, subscription details, and high-intent lead form submissions like quote requests or demo bookings.

Sensitivity Profile: Data carries the highest privacy compliance burden (GDPR, CCPA) and security requirements. It's intrinsically linked to individual financial and personal identity—the crown jewels that competitors would pay handsomely to access.

Scale Limitation: By definition, this represents only converted customers or active members—typically 2-5% of your total addressable market. For most brands, this means thousands or tens of thousands of records, not the millions needed for sophisticated statistical modeling.

Strategic Reality: This is "ground truth" data—not a proxy for intent, but a record of it. However, its scarcity makes it inefficient for broad-reach prospecting when used in isolation. Instead, its primary strategic value lies as a high-fidelity "seed audience" that provides the definitive behavioral and demographic signals for building lookalike models. It's the DNA from which scalable growth strategies are cloned.

The Hidden Challenge: Most brands treat this apex data as their complete first-party asset, not recognizing that its true power emerges when combined with the vastly larger datasets below.

The Middle: On-Site & In-App Engagement Data (The Intent Layer)

Below the apex lies a broader, more scalable layer capturing active interest before conversion—the behavioral breadcrumbs that reveal customer consideration paths.

Data Types: Email sign-ups, product views, cart additions, content downloads, video completion rates, repeat visits to specific categories, search queries, and time-on-page patterns across owned properties.

Sensitivity Profile: Generally tied to pseudonymous identifiers like cookies or logged-in user IDs. Less sensitive than transactional data but more revealing than anonymous browsing patterns. This data signifies demonstrated intent rather than completed transactions.

Scale Advantage: Significantly larger than apex data—typically 10-20x the volume. This captures prospects actively evaluating your brand across the entire consideration funnel, not just those who've converted.

Strategic Value: This is the "intent layer" that fuels mid-funnel optimization—retargeting, lead nurturing, dynamic creative personalization, and abandoned cart recovery. More strategically, analyzing this data reveals friction points in the customer journey and optimal messaging sequences that guide prospects toward conversion.

The Missed Opportunity: Most advertisers use this data reactively for retargeting rather than proactively for audience intelligence and creative optimization insights.

The Base: Campaign Impression & Web Pixel Data (The Scalable Signal)

At the foundation lies the least sensitive but most voluminous tier—and the biggest missed opportunity in modern advertising.

Data Types: Raw impression logs from DSPs, ad server logs, pixel fires from site visits, and programmatic auction participation data. Every bid request, every ad served, every site visit—regardless of subsequent engagement.

Sensitivity Profile: Typically pseudonymous, linked to cookies or device IDs rather than personal identifiers. Individual impression events carry minimal privacy sensitivity, making this the most collaboration-friendly data layer.

Scale Supremacy: This dwarfs all other data layers—often billions or trillions of data points monthly. It represents every single touchpoint your brand has purchased across the digital ecosystem, capturing both customers and the 95%+ who haven't converted yet.

Strategic Goldmine: While individual impressions are weak signals, the aggregate patterns reveal intelligence impossible to obtain elsewhere:

- True Cross-Platform Reach: Actual audience overlap and frequency across platforms, beyond self-reported platform metrics

- Pre-Conversion Behavior Mapping: Where your best customers consume media before they visit your site—revealing untapped inventory opportunities

- Competitive Intelligence: What content environments and publisher networks consistently attract your highest-value prospects

- Temporal Insights: When different audience segments are most receptive to messaging, beyond basic dayparting assumptions

The Strategic Imperative: This base layer provides the massive scale needed for statistically significant audience discovery and behavioral modeling. When combined with apex seed data, it enables sophisticated lookalike modeling that can identify new customer segments with precision impossible using transactional data alone.

The Activation Challenge: Why Most Brands Fail to Capitalize

Here's the uncomfortable truth: despite understanding this pyramid conceptually, most advertisers only systematically activate the apex and middle layers. The base—their largest proprietary data asset—remains largely untapped due to four critical barriers:

1. Technical Complexity: Unifying impression data across platforms requires data engineering expertise most marketing teams lack

2. Analysis Latency: Traditional data warehouse architectures treat impression logs as historical reporting data, not real-time intelligence

3. Collaboration Friction: The most valuable insights require combining impression data with external datasets, but data sharing is legally and technically complex

4. Resource Constraints: Extracting actionable patterns from billions of data points requires statistical modeling capabilities beyond typical marketing team resources

The result? Brands make audience decisions with incomplete intelligence, while their most valuable proprietary insights remain locked in data warehouses.

The Competitive Implication

As privacy regulations tighten and third-party data becomes less reliable, the brands that can systematically activate their entire first-party data pyramid—particularly the massive impression data foundation—will capture disproportionate competitive advantages.

The pyramid framework isn't just conceptual—it's a strategic imperative. The apex provides the truth, the middle layer provides the intent signals, but the base provides the scale needed for statistically significant audience discovery and behavioral modeling that drives sustainable growth.

The question facing every advertiser: Are you activating your complete first-party data pyramid, or are you competing with one hand tied behind your back?

In our next post, we'll dive deep into why your impression data represents the largest untapped opportunity in your marketing stack, exploring the hidden intelligence it contains about your customers' pre-conversion behavior and the audience insights most advertisers are completely missing.