The Privacy Sandbox was announced by Google in August 2019.

The proposal was set to change advertising online. Third-party Chrome cookies were going to expire, the industry would move to a privacy safe era, the level playing field was going to flatten, and new waves of innovation were going to transform the $600 billion digital ad industry. Under pressure to introduce privacy features to its adtech stack, and beat off regulators, Google’s Sandbox would also ease concerns over its tracking capabilities.

However, it was not to be, as Google met stiff opposition from competition regulators, after years of wrangling and criticism of the Privacy Sandbox model. On July 22, it announced that third party Chrome cookies would be phased out by consumer choice.

“We expect that overall performance using Privacy Sandbox APIs will improve over time as industry adoption increases,” Google said. “At the same time, we recognize this transition requires significant work by many participants and will have an impact on publishers, advertisers, and everyone involved in online advertising”.

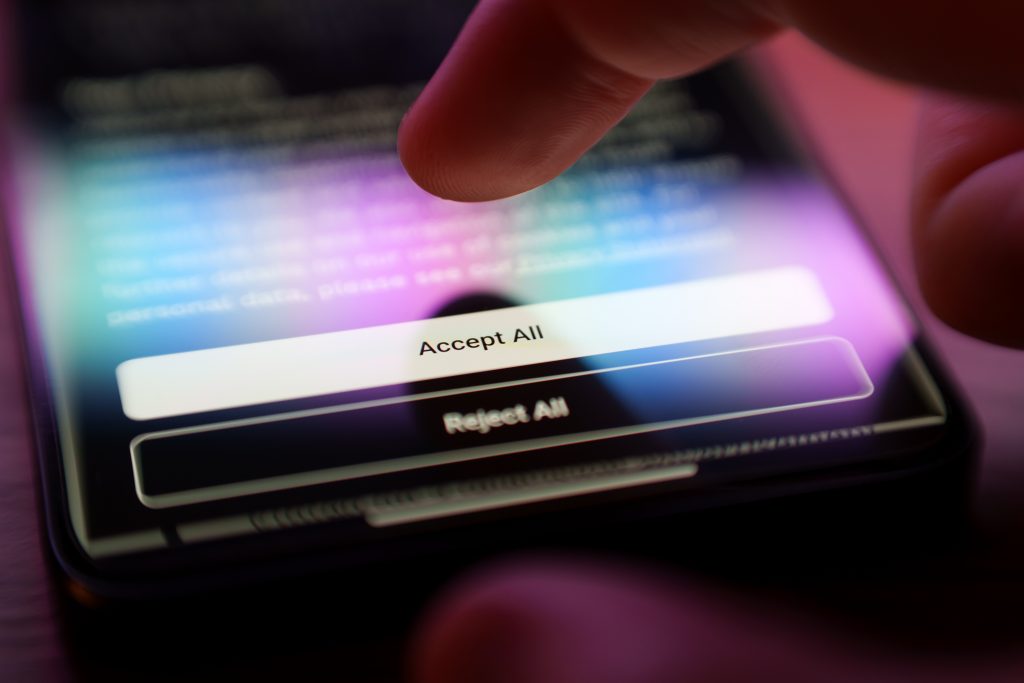

The company further stated: “In light of this, we are proposing an updated approach that elevates user choice. Instead of deprecating third-party cookies, we would introduce a new experience in Chrome that lets people make an informed choice that applies across their web browsing, and they’d be able to adjust that choice at any time. We're discussing this new path with regulators, and will engage with the industry as we roll this out.”

Hence, the cookie phase out will be decided by how aggressively Google promotes their tracking preferences to consumers, while also ensuring any steps it takes is palatable to regulators.

The UK Competition and Markets Authority and the Information Commissioner’s Office (ICO) had serious concerns about Google’s Privacy Sandbox model, and in the weeks leading up to Google’s about-turn, adtech companies had released their own reports that pointed to a wipe-out in publisher CPM’s.

Privacy principles to be upheld

The ICO, in response to Google’s shock announcement, said it would continue to be vigilant: “We will monitor how the industry responds and consider regulatory action where systemic non-compliance is identified for all companies including Google.”

The industry, for its part, is moving on, especially the group of digital identifier companies that have developed software to enable marketers to accurately reach audiences without tracking cookies. Privacy, and cookie tracking, was firmly established as a mainstream consumer concern. In a December 2023 Statista survey in the US those aged between 25 and 34 said 81 percent were concerned about data privacy when interacting with brands digitally. Something had to change on the privacy front from Google, which has lost the battle with Apple over protecting consumers.

Third-party cookies have been an important part of the digital marketing landscape, but come 2025 or 2026, they will be gone. Digital ad identifier firm ID5 said it recognized the limitations of third party cookies, noting “they needed synchronization across thousands of domains, causing significant latency and sustainability issues; they had poor match rates, leading to missed opportunities for brands to reach their target audiences; they posed significant data leakage risks for publishers; they couldn’t ensure legal compliance for consent and data processing; and last but not least, third-party cookies were not supported in Apple’s Safari browser, excluding a significant – affluent – portion of the market”.

So, whether you think Google has let down the digital media and advertising community via its latest decision does not matter. The market has moved on. The Martech Weekly, a global publication that has tracked the cookie phase-out story, said the way Google presents the tracking button will be crucial to the process.

“It will depend on the UX and wording of the one-time consent prompt but it’s likely that most users will opt out of the cross-site tracking and stalking ads that are associated with 3PCs,” the publication said in its paid newsletter. So, if most users choose to opt out, the end result won’t be much different to Google shutting them off on users’ behalf; the only difference is that users made the decision, not Google.” This viewpoint was backed up by an influential US adtech title, AdExchanger.

“There are also practical concerns about how Google will design its opt-in for Chrome. Opt-ins have lower acceptance rates than opt-outs, but the devil is often in the dark patterns that nudge people in one direction or the other,” AdExchanger wrote.

The new consumer consent model

For sure, how Google presents the cookie consent decision will impact the pace at which its new two-tier advertising offering takes shape. Google said it will introduce a new feature: a one-time prompt allowing users to establish preferences that are applicable across their Google browsing activities. However, Google has not said when the new feature will roll out to users. The company has said it will introduce a new feature: a one-time prompt allowing users to establish preferences that are applicable across their Google browsing activities. But, Google has not said when the new feature will roll out to users.

Google, for its part, promised it will continue to uphold and deliver on the privacy principles outlined in its Sandbox model, as regulators (mostly in the UK), will be monitoring new announcements. Again, agencies and other players in the ad ecosystem realize that new privacy rules have changed the game.

“It’s important to understand that Google plans to introduce additional privacy controls, so the importance of first-party data remains unchanged. Big picture, we should all expect the continued focus on privacy to have significant impacts on our ability to accurately track and measure various aspects of our marketing,” wrote James Lawrence, Co-Founder of Rocket Agency.

Other adtech players see a future in digital advertising - led by the buy-side - of developing solutions that eliminate the need for matching ID’s, and involving agencies, marketers, and industry bodies.

“There is a huge commercial opportunity in the ID-less space, but also a pressing need to establish sustainable buying mechanisms for you and your clients,” said Allan Tinkler, commercial director at Anonymised. “[We] support a future where 3PCs are no more, IP addresses have been redacted by browsers and ID solutions continue to be limited in scale (or deemed non compliant). Without alternative privacy enhancing ID-less technologies, programmatic buying of the quality web is at the whims of big tech and regulators.”

It’s also worth noting that while Google’s power over the market is significant, there are strong growth opportunities in other parts of the advertising sector, as noted by UK-based adtech start-up investment firm First Party Capital.

“Google is just another part of the media and marketing ecosystem. Granted, it is outsized on the open web - but the big G does not dominate high-growth areas of ad tech,” the UK based adtech investment start-up firm said. “Remember, we operate in a media and marketing kaleidoscope comprising micro-walled gardens, monolithic walled gardens, the vast array of media channels (including TV, OOH, retail media and more) and the curated (formerly open) web.”

07/25/2023

07/25/2023